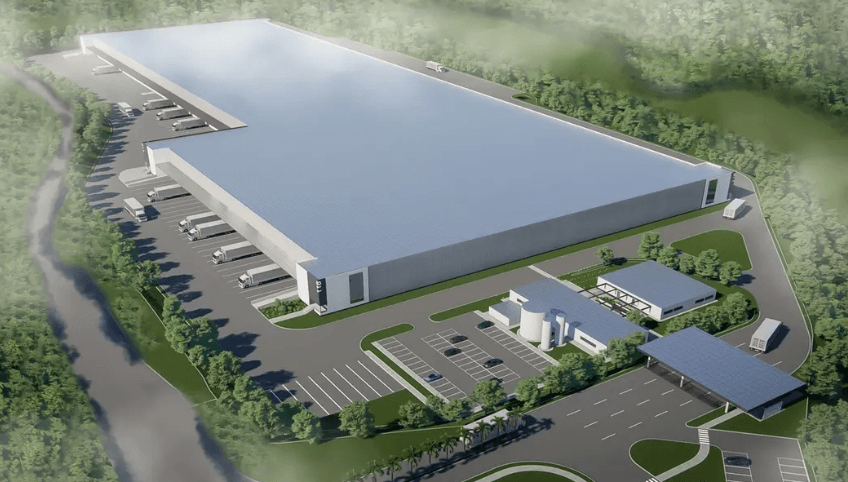

Somos especialistas full-service em galpões logísticos e industriais

+300

Clientes em todo o Brasil25

Estados + DF com negócios realizados+3,18M

m² alugados+1,3 bi

De R$ em vendas+1,3M

De ABL em definição de produtos e estudos de BTS+450K

m² de armazenagem urbana+1,9M

m² sob gestão comercial+3,1M

m² em gestão de contratos209

Contratos sob gestão

Assessoria em locação de galpões logísticos e industriais, consultoria especializada, projetos sob medida (BTS) e mais.

Mais detalhes